LAST UPDATED 08/15/19

www.alphonsemourad.com

www.uscorruptjudges.com

www.bostonmandelascandal.com

ALL LEGAL DOCUMENTS PERTAINING FOR THIS CASE ARE ON PUBLIC RECORD AT THE BOSTON FEDERAL COURT HOUSE AND THE INTERNET WORLD WIDE.

Website is updated daily please check back periodically.

www.uscorruptjudges.com

U.S. BANKRTUPCY JUDGE CAROL KENNER

U.S. BANKRTUPCY JUDGE CAROL KENNER

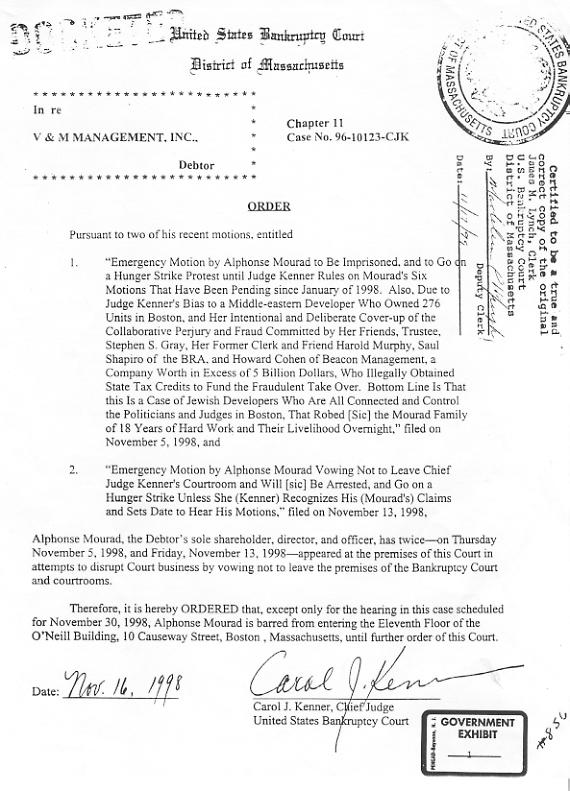

Upon the motion of the BRA, City of Boston and Department of Revenue, Bankruptcy Judge Carol Kenner appointed a bankruptcy Trustee for V&M Management (Stephen Grey), thus removing me (Mourad) from my position as President pf V&M Management, Inc. These three governmental entities made it clear to Judge Kenner that they wanted me (Mourad) out, and would not do business with me because I (Mourad) took a stand in the City of Boston against double standards, racism and discrimination toward the minorities in Boston. In my (Mourad's) experience, and opinion, Boston was the most racist city in America. Judge Kenner was biased toward Middle Easterners, and later barred me (Mourad) for life from entering the U.S. Bankruptcy Courtroom and had me (Mourad) arrested for violating her order, which had already expired, because the V&M Management bankruptcy case was over. For a complete history, look at the Kenner sub-button "Kenner Impeachment" and "Mourad Arrest" under http://www.uscorruptjudges.com/.

The Judge Kenner-appointee Trustee, Stephen Grey, came up with a $100,000 appraisal for the 276 unit Mandela complex. I (Mourad) countered with a $5.5 million offer to protect the creditors and tenants and to take the property back. But Judge Kenner refused to acknowledge the offer, and allowed the government to complete its takeover of the property and ultimately approved the Trustee sale of the property to Beacon Residential Properties and Howard Cohen, CEO, who played a major political part in wrestling the V&M property from me (Mourad) to his (Cohen) ownership.

To see and witness Harold Cohen celebrating his takeover of Mandela in a video speech, click onto http://www.jewishtakeover.com/.

CONGRESS OF THE UNITED STATES

House of Representatives

Committee On The Judiciary

2138 Rayburn House Office Building

Washington, DC 20515-6216

202-225-3951

December 22, 1998

Mr. Alphonse Mourad

125 West Street

Hyde Park, MA 02136

Dear Mr. Mourad:

Thank you for your correspondence regarding judicial misconduct. You have inquired as to the procedures of the House Judiciary Committee on investigating complaints against Federal judges.

Due to the limited resources of the Committee to investigate the complaints received, and to ensure fairness to all individuals involved, Congress established a procedure in 1980 to be utilized as the primary means of investigating and adjudicating judicial misconduct complaints.

The Judicial Councils Reform and Judicial Conduct and Disability Act of 1980, 28 U.S. C. § 372(c) ("The 1980 Act") established a mechanism for the presentation of complaints against federal judges (with the exception of Justices of the United States Supreme Court, for whom no formal complaint mechanism exists other than filing a complaint with Congress). It is the considered policy of the House Judiciary Committee to defer, except in exceptional circumstances, to the complaint procedures of the 1980 Act. You should, accordingly, take all possible steps to avail yourselves of those procedures before bringing die matter to this Committee.

Under those procedures, a complaint alleging that a federal judge has engaged in conduct prejudicial to the effective and expeditious administration of the business of the courts may be filed with the clerk of the U.S. Court of Appeals for the circuit in which the federal judge to be complained against sits.

Each complaint is considered first by the Chief Judge of the circuit, who determines whether or not the complaint raises an issue that should be investigated. If the complaint is against the Chief Judge, another judge will make this determination.

If the complaint is directly related to the merits of a decision or procedural ruling rendered by the judge against whom the complaint is lodged, the complaint will be summarily dismissed.

The proper recourse to challenge the merits of a judicial ruling is by way of appeal, at the appropriate time, to a court with jurisdiction to hear such appeals. The filing of a complaint of judicial misconduct under the procedures set forth in section 372(c) is not a device for further review of judicial rulings.

If the Chief Judge determines that an investigation is necessary, he or she will appoint a special committee of judges for that purpose. The special committee will report to the judicial council of the circuit, which will decide what action, if any, should be taken.

A complaint must be filed in writing on a form that has been developed for that purpose. If you need the form, it is suggested that you call the clerk of the appropriate U.S. Court of Appeals, and the clerk can provide you with a copy of the form.

This letter is not meant to suggest that the filing of a complaint of judicial misconduct is appropriate in your situation. It is intended only to inform you and suggest that any complaint that is to be filed should be filed first under those procedures.

If a party has availed itself of the Judicial Councils Reform and Judicial Conduct and Disability Act procedures, and remains dissatisfied, they may implore a Member of the House to bring such a complaint to the attention of the Judiciary Committee.

Again, this letter is not meant to suggest that you file a complaint under the 1980 Act or that you contact your representative requesting that a formal complaint be filed. I hope this assists in informing you as to the procedures established by Congress and followed by the Judiciary Committee.

Sincerely,

HOWARD COBLE

Chairman

Subcommittee on Courts and Intellectual Property

HC/mg

United States Bankruptcy Court

District of Massachusetts

(Eastern Division)

Chapter 11

IN RE:

Case No. 96-10123-CJK

V&M Management, Inc.

Debtor

ALPHONSE MOURAD'S NOTICE OF HIS PETITION FOR IMPEACHMENT OF CHIEF JUDGE CAROL J. KENNER TO

THE HOUSE JUDICIARY COMMITTEE IN WASHINGTON D.C.

The Following is the exact complaint filed with The House Judiciary Committee:

Mr. Blaire Merritt Council

Court Sub-Committee & Intellectual Property Rights

Dear Mr. Merritt,

I write to you with regard to Massachusetts Bankruptcy case (NO. 96-10123-CJK) in which I have cause to believe that the Judge presiding over my case - Carol J. Kenner - has knowingly perjured herself before the Circuit Council for the First Circuit when questioned about pertinent particulars regarding the case. In the exhibits that follow, it will become evident that Judge Kenner is unfit to uphold the appointment of Chief Federal Bankruptcy Judge and should be impeached from her chair. See Exhibit "1,", entitled Alphonse Mourad's Motion For Recusal Of Chief Judge Carol J. Kenner On The Ground Of Her Committing Perjury To The Judicial Council Of The First Circuit. This Motion will demonstrate in detail the issues at hand.

As the former owner and manager of 276 low-income units- I have come to experience Judge Kenner's unethical, vindictive, and illegal behavior first hand. After careful review of the enclosed exhibits, I am confident that the Court Sub-committee will find just cause to open an impeachment hearing on Chief Federal Bankruptcy Judge Carol J. Kenner and find her guilty of illegal behavior.

The primary issue being brought before the Committee is that of judicial perjury. There are several secondary issues which suggest judicial misconduct and arguably impacted the unfortunate course this case took. The judicial misconduct that Judge Kenner took part in effected me directly as the owner, manager, and sole stock holder of a property worth in excess of $10 million dollars. The following four issues are the driving force behind my belief that Judge Kenner is no longer capable of upholding the integrity and honesty befitting of a United States Federal Judge.

The undisclosed relationship between Attorney Harold Murphy &

Trustee Stephen Gray: Harold Murphy and Hanify & King represented Stephen S. Gray in two separate cases, In re Patriot Paper Corp., Chapter 7, No. 93-12482-CJK and In re American Shipyard Corp., Chapter 11, Case No. 11, 96-11752, while simultaneously representing V&M Management in which Stephen Gray was also appointed Trustee.

Stephen Gray, on April 5, and April 10, 1996, committed perjury on two counts by signing two verified statements under oath, and in violation of bankruptcy rule 2007.1, that he had no connection to the debtor or the debtor's respective attorneys.

A finding by the Office of the Bar Counsel on July 27, 1998, states the following, "It does appear that trustee Gray filed two false, or at least grossly inaccurate, disclosure statements with the Bankruptcy Court" (Exhibit "2"). Again the Court left this illegal behavior unchecked.

Judge Carol J. Kenner lied under oath: (Again, see Exhibit "1")

Judge Kenner knew that Harold Murphy was representing Stephen Gray at the same time as V&M because the Patriot Paper case, in which Murphy was representing Gray was also being heard before Judge Kenner, in the very same court room, and at the very same time the V&M case had been ongoing. Therefore, Judge Kenner allowed perjury to be committed by Gray on two counts.

Is it not ironic that on April 2, 1996, Judge Kenner appointed Stephen Gray as Chapter 11 Trustee for V&M Management (whose counsel was Harold Murphy) and then only nine days later Judge Kenner received a motion before her from Stephen Gray and his counsel Harold Murphy regarding a separate case, In re Patriot Paper Corporation.

A motion had been filed for her recusal and a complaint was submitted to the judicial conduct committee. Judge Kenner, under oath, falsely stated she was not aware of Murphy's representation of Gray in the Patriot Paper case.

The Court artificially devalued the property from $9m to $100,000: The City of Boston and the Department of Revenue assessed the land value of the Mandela property, not including the building, at $10 million. While the property only received subsidies that were 30% below market value from HUD, the property was still able to receive a certified appraisal in excess of $7 million and a loan commitment from the Multi-Loan Network for $5.5 million (See Exhibit "3"). The property would receive 100% of its subsidies as of November 1996, which would have increases the value even more.

Trustee Gray asserted that the property was only worth $100,000 from an appraisal that he would not disclose to anyone, and that stated that the property could not be salvaged. In the mean time Gray was receiving approximately $3 million dollars a year in gross income from the property.

Since the Trustee claimed the property was only worth $100,000, Alphonse Mourad offered to purchase the property back with his $5.5 million dollar loan commitment (See Exhibit "4," entitled Motion To Compel Trustee To Accept Purchase Offer).

Judge Kenner denied the offer and allowed the bankruptcy case to proceed for years. Later Trustee Gray filed his own Plan of Reorganization in conjunction with Beacon Residential Properties and the Mandela Residents Cooperative Association. They were able to illegally obtain state tax credits by the fact that Judge Kenner ruled that Stephen Gray was the owner of the Mandela Apartments and therefore had site control, which is a prerequisite for qualifying for tax credits. Stephen Gray merely managed Mandela; he did not own it.

The Court never investigated the Fraudulent Notes that forced the property into Bankruptcy: On January 2, 1996, V&M Management, Inc. and Mourad sued Mario Nicosia, Judith Moriarty, and L&N First Mortgage Realty Trust, in Suffolk Superior Court, C.A. No. 96-0036D, seeking to restrain a scheduled January 9, 1996 foreclosure of a mortgage securing the March 29, 1985 Note. V&M's accountant calculated and offered $13,511 to pay off the Note. Nicosia and Moriarty refused V&M's tender.

On a January 5, 1996 hearing, Mario Nicosia and his attorneys presented a forged and fraudulent March 29, 1985 Note for $50,000 to the Court and claimed it carried a 21% interests rate, when in fact the original and authentic March 29, 1985 Note only carried an 18% interest rate.

The foreclosure of this fraudulent note led to a scheduled January 9, 1996 auction of the property. The auction precipitated V&M Management to seek protection in the Bankruptcy Court by filing for Chapter 11.

Judge Kenner denied an evidentiary hearing on Nicosia's fraudulent Note.

Judge Kenner finally allowed, on August 7, 1997 Mourad's Motion To Compel Production Of Original Notes For Handwriting Analysis (See Exhibit "5"). Soon after, Forensic Handwriting Examiner, Ronald H. Rice examined the Nicosia's Notes and concluded in his August 28, 1997 Affidavit (See Exhibit "6") that "The handwritten signatures on the questioned document, Exhibit Q1A, were not written or signed by Alphonse Mourad." Judge Kenner later ruled that Rice's affidavit was moot and that Mourad had no standing to bring the complaint. How could Mourad have no standing when she had previously allowed Mourad's Motion requesting the production of Nicosia's original notes.

The Court allowed Trustee Gray to Profit $1.3 million dollars without paying taxes

During the duration of Stephen Gray's Trusteeship of V&M Management, Gray had accumulated approximately $1.3 million in profit and failed to pay any taxes for the years 1996 and 1997.

On or about August 20, 1998, Mourad finally received the K-1 tax return from the Trustee's accountant.

The tax liability with penalties and interest exceeding $1.3 million was given to Mourad without Mourad every receiving one dollar of the $1.3 million.

A motion was filed by Mourad to Judge Kenner asking her to make the Trustee liable for paying the taxes on the income he had received and kept (See Exhibit "7"). She denied the Motion (See Exhibit "8").

I appreciate your willingness to at least examine the facts I am putting before you. This has been one of the most high profile, contentious and politically influenced bankruptcy cases in the history of the Bankruptcy Court in Massachusetts and possibly nationally, consisting of approximately 200 pages of docket sheets. The irreversible damage that has taken place as a result of the devious collaboration and cover-up between Judge Kenner, Harold Murphy and Stephen Gray has left many individuals with nothing but heartache, worry, and financial ruin. I have lost 15 years of investment, assets and hard work. My assets and livelihood were completely and intentionally stripped from me by Judge Kenner. Several family households had mortgages taken out on their homes to support V&M Management, and affordable housing in Boston. All of them are now responsible for paying for their homes twice over, for they were all free and clear before this all happened. As a result, members of the Mourad family who have invested approximately $1,000,000 of their personal assets and savings in my defense have suffered from severe nervous breakdowns and other stress related illnesses. Finally, I am suffering from personal bankruptcy, and Judge Kenner expects me to pay the Federal Income Taxes on the $1.3 million Stephen Gray has pocketed as profit. I pray you are able to see how Judge Kenner deliberately destroyed the entire Mourad family. I truly believe the truth and justice will emerge and prevail in the end. Again, I thank you.

Due to the voluminous amounts of exhibits, the parties served on the service list can examine the exhibits accompanying this Motion at the Bankruptcy Court.

I declare under the penalties of perjury that the statements made in this complaint are true and correct to the best of my knowledge.

Alphonse Mourad

125 West Street

Hyde Park, MA 02136

December ____ , 1998